Does the title shock you?

I’m a money expert and always talking about the perils of being in debt.

Stress and despair – something you need to get out of as soon as possible.

And that’s still true… with this caveat…

Not all debt is bad debt…

Let me elaborate.

One of the reasons that debt is such a big topic of discussion right now is that the statistics on personal debt are skyrocketing.

And you would think, that as a culture, our concern about it would grow alongside.

But the truth is that our lack of concern for debt in our culture is shocking.

Because like divorce, debt has become so commonplace that we dismiss it as being as enslaving as it is.

We just assume and fall into the herd mentality of our times where we can’t imagine having a home without a mortgage, a car without a car payment, college without a student loan, or a credit card without a balance.

I talked about this at a recent Paleo f/(x) conference (click to watch a clip from that talk)…

We are living beyond our means and making the banks rich as they continue to offer new products to help us dig ourselves in a little deeper.

And while you have heard me talk about debt before… did you know that there is actually some debt that is “good.”

Life and debt is not black and white and this is one area where there is some grey.

With that, what I mean is that not all debt is harmful. In fact, taking on some debt may be

beneficial to you.

I expand on this in both my ADE (Accelerated Debt Elimination) course and my flagship Money Mastery wealth building program.

But the bottom line is that there are different kinds of debt and some of them are more harmful to you than others.

While my personal debt philosophy includes taking a zero debt stance – what I mean by that is zero “bad” debt.

Here’s the difference.

Bad Debt

Bad Debt is debt that you use for personal consumption. It’s the stuff you buy that you can’t afford. It’s the purchases you make that you don’t need. It’s the money that goes out and never provides any return at all.

Credit cards and car loans are at the top of the bad debt list. The compound interest creates a money-sucking funnel that is designed to keep you in debt while restricting your freedom and potential investment opportunities for years.

Maybe forever.

This is why we always look at tackling credit card debt first.

The money that you’re paying to bad debt, if invested correctly, would fund your freedom in ways you can’t even imagine.

For example, according to a 2012 survey conducted by American Express, the average American family spends nearly $5,000 on a typical summer vacation. If that family invested that $5,000 at a 20% rate of return, they would amass around $476,000 in twenty-five years—and that’s without adding additional money to the investment.

Good Debt

Good debt is the debt that allows you to make money to not only pay back the amount you borrow in full, but pays back even more. So you make money.

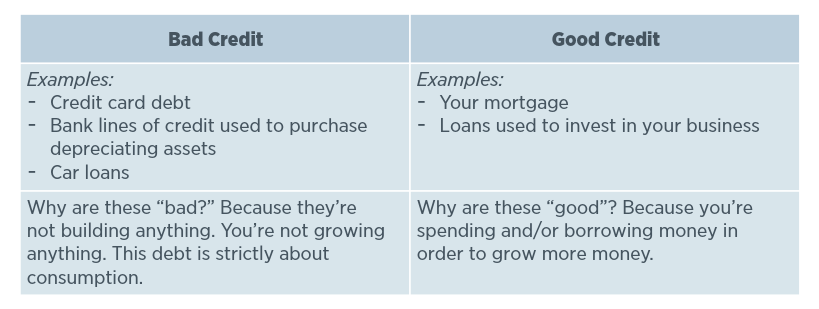

See some examples in the table below…

So while personally I don’t carry any bad debt – my credit cards are all paid off and I don’t have a car payment, professionally I have debt that I’ve acquired to capitalize my new business ventures.

Because all debt carries a risk, I work to take on as little as possible.

The good debt pays itself off in returns and ends up making me money – something bad debt can never do.

The lesson here is to be thoughtful about debt. Make a vow to get out of bad debt as fast as possible. Make another vow to not accrue any MORE bad debt.

If there’s an opportunity to take on a reasonable amount of debt that will give you a return on your investment- paying off that debt in full and more… exercise wisdom and consideration with that.

In all areas of money mastery – the mindset, the education, and a smart money system will give you a future that has less stress, more freedom, and abundance in your health and wealth.